11.01.2009 original publish date

11.03.2009 edited. Previously titled, Economic Crack. There Are Still…No Weeds in My Garden.

05.17.2010 updated data & repaired links

10.04.2012 repaired broken links / format edit

Economic Crack. Risk to the U.S. Economy

original article written by Net Advisor™

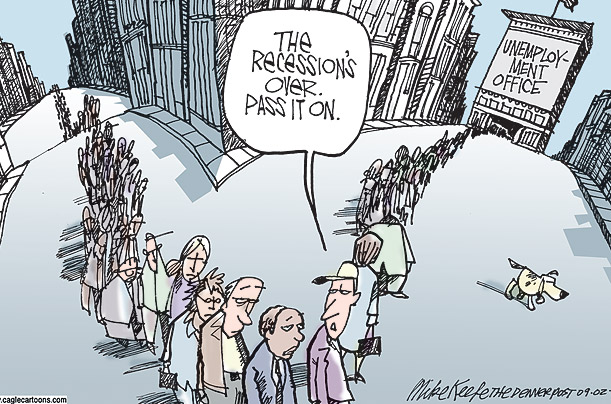

We have heard people in government, economic advisors, the FED, and some media calling the “recession over.”

The question:

Is the recession really over, or are we just ignoring a lot of data that may suggest otherwise? If we ignore the data we don’t want to hear, we could then probably put our head in the sand and say…

there are no weeds in my garden

there are no weeds in my garden

there are no weeds in my garden

If we ignore the weeds in our garden, the weeds will take the garden. Let’s take a closer look at why the recession may not be over and could actually linger a lot longer.

First, let’s look at the “Utopia Trade.”

What is the Utopia Trade?

The Utopia Trade is when you create a scenario where the government floods money into the economy guaranteeing no one big will fail, and thus government is assuming most to all the risk, making it easier for financial markets to go higher. The thinking is the result will be an improved economy. But how much money is going into these programs to help the economy? We’ll you probably heard or recall maybe one of the programs: The $787 Billion Stimulus Act of 2009 signed by President Obama (Source: MS-NBC).

But wait, there’s more…

The FED has been buying up 80% of the mortgage loans out there, thus the FED IS the mortgage market, and the government IS everyone’s source of capital.

“In the mortgage-backed debt markets, the Fed has been buying upward of 80% of the bonds issued by agencies such as Freddie Mac and Fannie Mae.”

— Source: Wall Street Journal

How much is that? (Paraphrased slightly):

‘The FED intends to purchase $1.25 Trillion of agency Mortgage Back Securities (MBS)’ (i.e. “residential real estate loans” from Fannie Mae and Freddie Mac, etc.) The purchase activity began on January 5, 2009 and continued through March 31, 2010.

— Source: New York Federal Reserve Bank

But wait, there’s still more….

The government is flooding the economy not with just one stimulus program, but with a whole host of other programs that got very little media coverage. Essentially the government, including the FED, HUD, the Treasury, and the FDIC has additional spending, backstops, bailouts, and other loan loss guarantees. So, how much is that? As of 02-24-2009, $3.8 trillion (Source: Bloomberg).

But wait, there’s still more….

Are you sitting down for this?

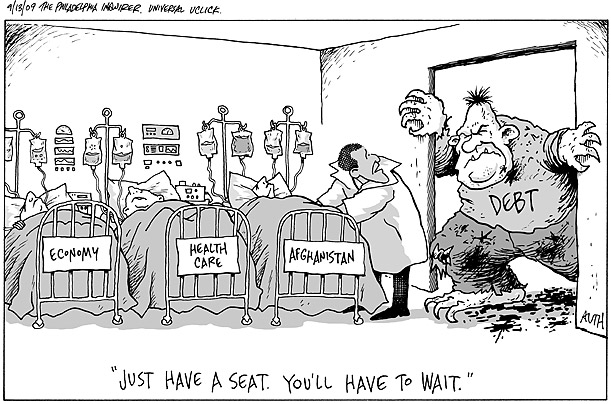

The total in financial commitments that the U.S. government has made to prop up the economy if necessary, amounts to a whopping $11.6 Trillion. That is not a typo: “Eleven-Trillion-six-hundred-billion-dollars!”

Note the above data does not include interest on borrows money. This does not count the approximately $5 Trillion worth of mortgages guarantees from failed Fannie Mae and Freddie Mac (Source: Wall Street Journal). During this time (11-17-2009), the entire U.S. National Debt was $12 trillion (Source: CBS News). Thus, the U.S. government is prepared and willing to double the U.S. National Debt plus interest on bailouts and stimulus programs. President Obama actually said the following:

“It is important though to recognize if we keep on adding to the debt, even in the midst of this recovery, that at some point, people could lose confidence in the U.S. economy in a way that could actually lead to a double-dip recession.”

— President Barack Obama (Source: Reuters, 11-19-2009)

It should be noted that President Obama made these public comments immediately after his China visit (11-15 to 11-18-2009). The main reason the President went to China (from my perspective) is to calm China down over the rapidly increasing U.S. debt, which China is the single largest holder of U.S. debt (Source: U.S. Treasury).

“A newly assertive Beijing is also expressing deep concern about the vast U.S. budget deficit and the sliding value of the U.S. dollar. China went public with its concerns earlier this year, when premier Wen Jiabao proclaimed in March that he was “worried” about China’s vast U.S. dollar holdings, which make up the majority of its more than $2 trillion in foreign exchange. China’s top banking regulator weighed in on Nov. 15, (2009).”

— Source: Bloomberg-Businessweek

Whether President Obama really believes in the statements made in China; or was it really to appease concerns of the Chinese the facts are, that less than three months later, the President has done nothing but to raise the national deficit (Sources: CBS News and Fox News ).

Thus the amount of government spending and guarantees of no failures, or virtually no loss of money if you are a bank or governmental agency continued the Utopia Trade for the stock market to move higher. At some point we have to take the training wheels off the economy, and allow the economy to run on its own.

The question was asked on 10-30-2009 whether the stock market had been running out of steam? (Source: NY Times).

The stock market isn’t “running out of steam.”The reality is that the market only APPEARS to be in recovery because we have put the economy on a Crack Stimulus Program.

Back on August 13, 2009 when the FED said they were thinking of raising interest rates I said that was a bad idea, and it is still a bad idea. Apparently, 3 months later the FED seemed to agree with the notion to hold off from raising rates too soon.

“…Federal Reserve policymakers appear to be in no rush to raise interest rates. The Fed is widely expected to keep its benchmark interest rate where it has been since December — near zero….”

— Source: Reuters, 11-01-2009

The FED has been keeping rates low, near zero percent. Doesn’t that mean that the economy still has risks? I thought the recession was “over?” or… “likely over.” What does that mean? “Likely Over.” That sounds like ‘maybe, but we’re not 100% sure.’ The shocker to me was when Dennis Gartman said the recession was over. I thought, gee, Dennis is right almost all the time. Maybe it is over.

I have HUGE respect for Mr. Gartman, and he has been one of the key people I have listened to over the last 20 years. Mr. Gartman could be right. But for some reason I am having a hard time calling a recession “over” when the government is racking up debt like no tomorrow (as said above), mortgages are underwater, unemployment is still high (PDF), and many states face double digit unemployment (PDF).

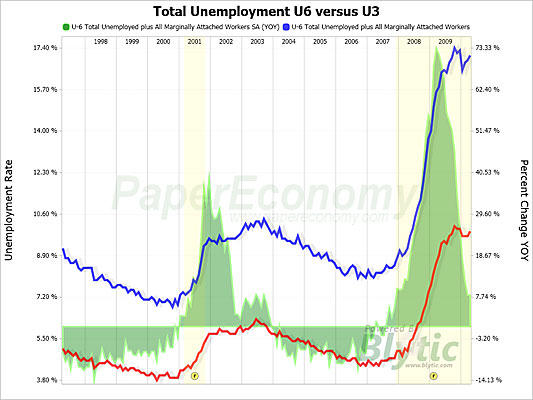

As we can see from the following chart, unemployment figures are a lot worse than the Obama Administration might be willing to acknowledge.

If you factor in the people who are underemployed and those who gave up (not currently looking for work), the unemployment rate would be 17.1%.

— Source: CS Monitor

If inflation is not a (current) concern, the government no longer needs to bailout anyone, the stock market was making everyone rich, the real estate crisis is effectively over, foreclosures are pretty much all done with, consumers have plenty of money to spend again, banks are no longer having financial issues, jobs are plentiful, and wages have never been better? Yep, the recession must be over.

Like I have preached since 2008, until the consumer is stable, the economy will not be stable.

If the government really wanted to stimulate the economy, it would not play parent and throw money where it thinks money should go. All the trillions in stimulus and bailouts has done nothing but increase unemployment (chart above). Government should be thinking more of what actually stimulates the economy: Lower taxes across the board, reduce capital gains, but all of that would mean the government could not spend more. Good idea. However the amount of money people could save from higher taxes and capital gains would mean more money consumers got to decide how to spend their money in the economy. That is what creates jobs. Consumer spending. Not government spending.

Maybe we should look at what worked to get us out of recession in the past?

Although the Obama Administration has blamed the Bush Administration for just about everything in Washington, this is a broad stoke of the paint brush, and not an accurate one. The issues go a lot deeper than that. One issue is the 2003 Bush tax cuts that Obama said were for the ‘wealthiest of Americans.’ According to a study by the Heritage Organization that way of thinking would not exactly be accurate.

The 2003 Bush tax cuts incorrectly labeled “for the so called wealthiest of Americans” (see Myth #10) did a few things including:

- created 5 million new jobs

- increased tax revenue

- actually raised not lowered taxes on the wealthy

- decreased taxes on middle income and lower income Americans, and

- turned the economy around from the 2002 recession

— Source: Heritage.org, 01-29-2007

“The economy lost 267,000 jobs in the six quarters before the 2003 (Bush) tax cuts. In the next six quarters, it added 307,000 jobs, followed by 5 million jobs in the next seven quarters”

— Source: Heritage.org, 01.29.2007

Economic Risks

The Obama Administration thinks if it keeps on spending more and more borrowed money, that will produce universal utopia. It hasn’t worked. Maybe trying something that has worked in the past and got us out of the last recession might be worth looking at? But to do this is to admit one is wrong, that might mean a “competing” political party had a better idea that helped more Americans with their personal financial situation than the current path has been able to achieve.

That is probably not the best way to get re-elected. But repainting the economy with an old economic brush that worked, still might be a good idea. For now and unfortunately, more and more deficit spending is the Obama solution.

This is the path toward an even bigger future fiscal crisis in America. It may not happen this year or next, but if government does not rein in meaningful spending, and properly address social programs such as entitlements, the banking/mortgage/consumer/credit crisis/ (add your problem here) of 2007-2010 will look like a joy ride at Disneyland.

I am not the only one who is concerned about this: There are numerous articles available to read, here is a sample of three of them:

“THE FEDERAL budget is on an autopilot course to ruin. Spending on the three big entitlement programs — Social Security, Medicare and Medicaid — grows automatically, consuming a large and growing share of the budget…”

— Source: Washington Post, 04-06-2008

“…Moody’s Investors Service predicts the U.S. will spend more on debt service as a percentage of revenue this year than any other top-rated country except the U.K. America will use about 7 percent of taxes for debt payments in 2010 and almost 11 percent in 2013, moving “substantially” closer to losing its AAA rating, Moody’s said last week.”

— Source: Bloomberg, 03-22-2010

“Obama administration’s planned budget, the gross national debt will reach 123% of GDP by 2020. Greece’s Debt to GDP ratio stands at 133% this year (2010).”

— Source: Heritage.org, 05-14-2010

A Call to Action or Trip to Fantasyland?

The President said last February (2010),

“It’s time to save what we can, spend what we must, and live within our means once again.” Obama urged congressional Republicans to support his call for a commission to study ways to bring down the deficit.

— Source: Marketwatch.com

“Living within in our means” and “bringing down the deficit” are both noble ideas and sound great as sound bites on the 6 o’clock news. The problem is, the Administration is doing anything but living within their means, let alone attempting anything material to bring down the deficit.

Try not to be mislead when you hear about trivial Washington spending freezes, or “Pay-Go.” All of this is pure hallucinogenic fantasy that does not address the current or long term rapidly increasing U.S. debt. Entitlement programs such as Social Security, Medicare and Medicaid are EXEMPT from the federal budget. This is the biggest part of the budget and Congress or the President won’t touch this fearing backlash from mostly elderly voters.

“Medicare, Medicaid, and Social Security — is also permanently enacted. Interest paid on the national debt is also paid automatically, with no need for specific legislation. (There is, however, a separate “debt ceiling,” which limits how much the Treasury can borrow.”

— Source: Center for Budget and Policy Priorities, page 2, parr 2, DTD 12-01-2009

After reading this, if one values fiscal stability in government, one might ask, “Are you kidding me?”

“In the 1983 Social Security Amendments a provision was included mandating that Social Security be taken “off-budget” starting in FY 1993. This was a recommendation from the National Commission on Social Security Reform (aka the Greenspan Commission). The Commission’s report argued: “The National Commission believes that changes in the Social Security program should be made only for programmatic reasons, and not for purposes of balancing the budget.”

— Source: Social Security.gov

FED Reluctant to Move on Interest Rates

The Federal Reserve (The FED) isn’t making a move on increasing interest rates right now. If the FED is smart, they won’t change the bias too far from a near zero rate policy either. If the FED gets a wild hair up its Dollar, and changes any bias on monetary policy, that could spark inflation very quickly. Change that picture, take that stimulus away, raise those interest rates, and the stock market will be forced to deal with the reality: No more Crack Stimulus.

Do risks to the economy indicate that we may be moving to deflation, suggesting an economic slowdown again, or is this a temporary drop?

Morgan Stanley economist Ted Wiesman suggested on 05-17-2010, that due to the Euro crisis, “that the medium-term impact of this situation will be inflationary and not deflationary.” Earlier this year the FED echo a similar thought that deflation was not a high risk (Source: Reuters). However recently we are seeing industrial commodity and grain prices fall, including oil prices plunging 13.96% [Source: CNN (PDF)]. Lower oil prices are good for consumers at the gas pump, however can be bad for the economy. A lower demand for commodities could mean the global economy may be contracting, not expanding.

China has been actively trying to slow down the rapid growth in their economy to reduce the chances of an economic bubble.

“China’s stocks fell, driving the benchmark index to a seven-month low, on concern (Chinese) government measures to cool the property market will damp consumer spending and curb demand for raw materials.”

— Source: Bloomberg-Businessweek (PDF), 04-27-2010

Is the Recession Over?

Keep in mind that the some of the people who said the recession is over are the same people who said we were not in a recession when we actually were.

“Federal Reserve Chairman Ben Bernanke told Congress today he doesn’t believe the economy will slip into a recession.”

— Source: Seattle Times, 03-28-2007

So the recession that was never here is ‘likely’ or ‘technically’ over now?

If the recession is “over” how come the following issue are still waning?

- Bank failures are rapidly INCREASING, not decreasing?

- U.S. 2009 foreclosures shatter record despite (government) aid

- Foreclosures hit a record in 2009

- Bankruptcies hit record levels in 2009

- Bankruptcies up 27% nationwide in 2010

- Long term unemployment is still a big problem

- 11.2 million people now receive unemployment insurance

- An all-time record of 39.68 million people (one in eight) Americans are now receiving food stamps, this is up from 32.2 million or one in ten from 2009

“The Agriculture Department said 39.68 million people, or 1 in 8 Americans, were enrolled for food stamps during February, an increase of 260,000 from January.”

— Source: Reuters, 05-07-2010

All of this somehow does not exactly seem like a recovery when more people are facing record foreclosures, record bankruptcies, a record number of Americans need help to even buy food, and depending on how one determines what is considered to be “unemployed,” we have anywhere from 9.9% to 17.1% unemployment. This sounds like symptoms of a 3rd World Country. In March of 2010, “24 (U.S.) states posted a increase in unemployment rates on a month-to-month basis” (Source: CNBC). Does all this have the markings of an economic recovery?

The Ex Factor

If we factor the stimulus and other government aid out of the equation, how would the economy really be doing? All of this government dumping money into the economy has not solved the above issues. Either the economy is a lot worse off than we care to admit, or the economic stimulus, etc., is just not having the intended change the Obama Administration had hoped for. The amount of liabilities, financial guarantees, backstops, and debt the U.S. is encumbering itself with poses a serious long term risk to the U.S. economy if government does not get control of their own financial house.

Follow-up report:

The Biggest Risk to U.S. Recovery is the U.S. Government

Images © respective owner(s)

Copyright © 2009-2010 NetAdvisor™ All Rights Reserved.

Revised copyright © 2012-2013 NetAdvisor.org® All Rights Reserved.

original content Revised copyright © 2012-2013 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.