02.09.2012 original publish date

04.11.2012 updated broken links

05.02.2013 Added numbered [brackets] for easier referencing

Fact Check: Understanding Who Really Pays Most of U.S. Taxes?

original article written by Net Advisor™

Excerpt: There has been much discussion (mostly political) that claims the so called “rich” just don’t pay enough taxes. This article is not in support of the wealthy or the poor, nor are we suggesting higher taxes. The purpose of this report is to help sort out some of the misconceptions with the facts in this 10-page report.

[1] Who Really Pays the Most in Taxes?

FACT: The so called “rich” actually pay more taxes in terms of actual dollars than anyone else.

According to the National Tax Payer’s Union – an “independent, non-partisan advocate for overburdened taxpayers” found that based on Internal Revenue Service (IRS) data:

- The Top 1% of all tax payers account for 36.73% of all taxes.

- The Top 10% of Americans pay over 70% of all taxes.

- The Top 50% of Americans pay over 97% of all taxes.

- The Bottom 50% of Americans pay zero to 2.25% of all taxes.

— Source: National Tax Payers Union (IRS data for tax year 2009)

[2] “The 1 Percent”

To be considered part of the “Wealthiest of Americans,” otherwise classified in the top 1% (tax bracket), one had to earn just $343,927 [Source: About.Tax Planning (2009)]. So after any legal tax deductions, a person (single or married filing jointly) with $343,927 income would pay 35% (35 cents of every dollar earned) or $120,374.45 to the federal government in taxes.

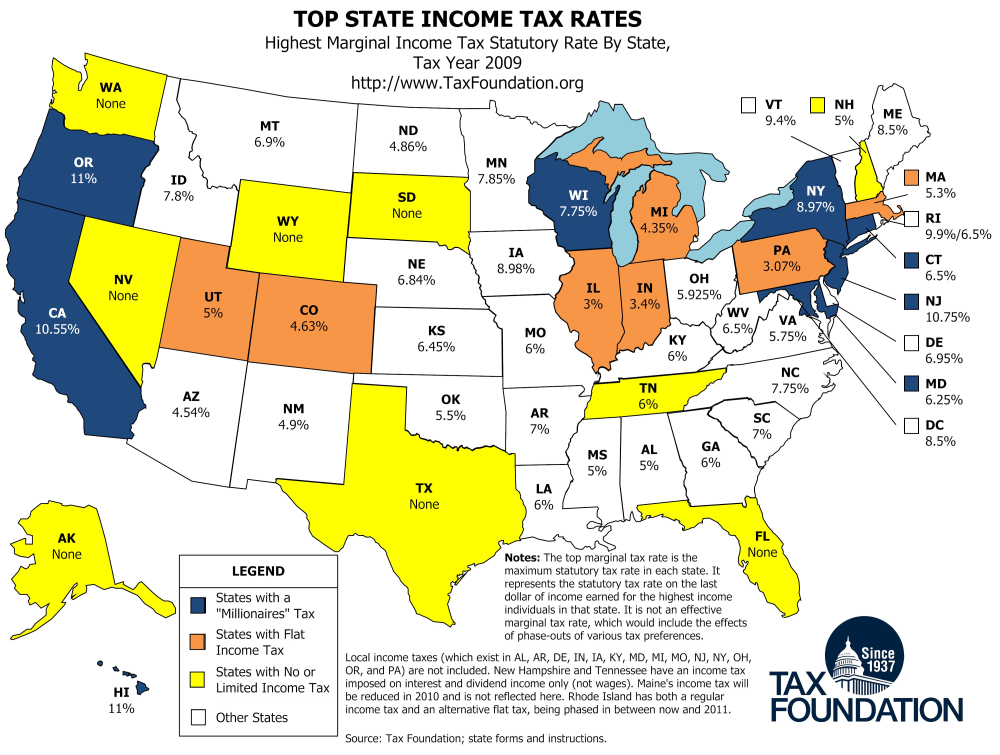

If you happened to live in a state that also has a state income tax, this would increase one’s over-all total tax payments. There are some states that have no state income tax at all, and two states only tax dividend and interest income.

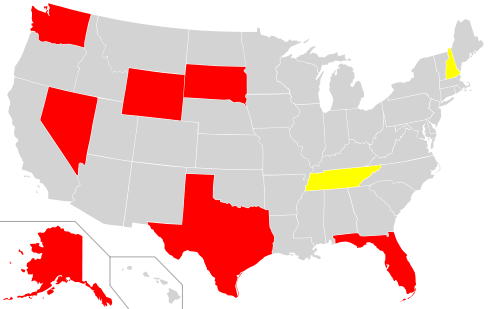

[3] The Seven States with No State Income Tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

New Hampshire and Tennessee (in yellow, map above), tax only dividend and interest income.

For the rest of the country, here are the top state income tax rates as of 2009. In 2011, Illinois raised their state personal income tax from 3 to 5% – a 67% increase (Report: NetAdvisor.org) The new governor of California is also looking to raise their already high state income taxes this year. We have not looked at other states.

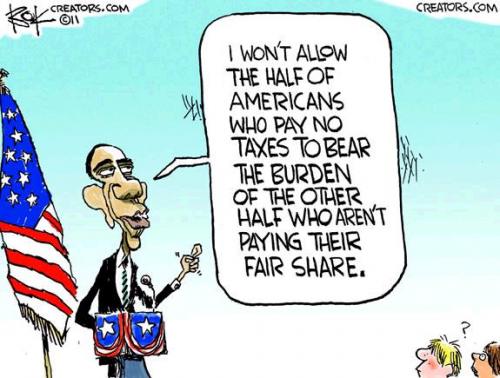

[4] In 2010, 45% of Americas owe no income tax.

“The roughly 45 percent of Americans who owe no income tax are heavily weighted in certain groups based on income and family status, according to the The Tax Policy Center, the nonpartisan research group that has run the numbers. More than half the tax-return filers in each of these groups owe no taxes: Those who earn less than $30,000, those who are elderly, and those who are single with children.”

— Source: CS Monitor, 04-12-2010

In 2011 Senator John Cornyn (R-Texas) said during a Senate floor speech that 51% of Americans paid no income tax. According to Politifact.com, this is a true statement.

“Fifty-one percent — that is, a majority of American households — paid no income tax in 2009. Zero. Zip. Nada.”

— Senator John Cornyn (R-Texas), 07-07-2011

[5] Argument: ‘The Rich Pay Lower Taxes than their Secretary’ – Not Really.

Political pundits attempt to create a lot of confusion when it comes to who is paying taxes. A report said ‘1,400 Millionaires Paid No U.S. Income Taxes in 2009.’ Although the fundamental principle of the article may be true, I would argue it is misleading as it has serious omissions.

- The report left out the fact that 10’s of millions of average Americans owed no taxes either, pretty much half the country; and yet we are supposed to single out those 1,400 ‘greedy bastards?’

- The report also ignored the fact that just because someone is wealthy, doesn’t mean they have to keep handing over their money to the government each year just because they still have some money left.

- The report also ignored the fact that even if one does NOT invest their previous years after-tax money, they are not subject to some arbitrary tax in the future.

- The report also ignored the fact that if one lost money investing; one is not subject to pay taxes on those losses.

- The report also ignored the fact that under IRS Rules, that some income is not taxable income.

[6] Does Warren Buffett Really Pay Less Taxes Than His Secretary?

We have heard the stories how one of the world’s wealthiest persons Warren Buffett ‘pays less taxes than his secretary.’

Buffett’s secretary is not on the Forbes Billionaire List and Buffett arguably pays far more in taxes than his secretary. In 2011, Buffett had reported income of over $62.8 Million and taxable income of $39.8 Million. Buffet reportedly paid $6.9 Million in federal taxes.

Forbes estimated that Buffet’s secretary probably earns somewhere between $200,000 and $500,000 a year – just slightly higher than the average secretary’s salary of $27,780 to $64,330.

Buffett’s secretary won’t likely be hitting the unemployment line or soup kitchen any time soon on that salary. And based on these numbers, Buffett pays more in taxes than his secretary.

[7] Earned Income vs. Investment Income

Next, we find that the political pundits often leave out that under current (2012) federal tax law, earned income (PDF) is taxed differently than investment income (2011 IRS Pub 550 FAQ, 88pps, PDF).

Why is this?

Capital gains is a tax on profit (generally from investments such as stocks, mutual funds, corporate bonds, and other investments). This money was already taxed when it was earned as income.

The government actually taxes investment income twice:

1st – When it was earned as income (such as money from a regular job (W2 income), or other 1099 wage related income).

2nd – When the after tax income was invested and made a profit, capital gains tax can be accessed on the profit.

[8] Who Qualifies for the Long Term Capital Gains Tax Rate?

Everyone! It does not matter whether your profit is $1.00 or $100 million; the tax treatment is applied equally to all.

[9] How Do I Get the Long Term Capital Gains Tax Rate?

All one has to do is hold a qualified investment (stocks, funds, etc) for one year and 1 day to get the long-term capital gains rate.

If one holds such qualified investments one year or less, then they are taxed at the ordinary income tax bracket.

Side Note: Profits earned in a qualified retirement account are not subject to annual income tax and are taxed when withdrawn at then ordinary income tax rate. Roth IRA accounts are exempt from taxes as money invested in Roth IRA accounts already paid taxes on the original earnings.

[10] What is the Purpose of a Long Term Capital Gains Tax Rate?

The idea of long term capital gains is to encourage investment and to help the economy. The government penalizes one for profiting on short-term (one year and under) investments by having those profits taxed at a generally higher rate – the ordinary income tax rate.

[11] Why is Some Income Tax Exempt?

First one needs to understand that investing in some municipal bonds may be exempt from state and or federal taxes. Also investing in U.S. Treasuries (aka U.S. debt) are generally federally tax exempt. This would explain why some income is not taxable.

[12] So Why is Warren Buffett, Mitt Romney etc., Apparent Income Tax Rate So Low?

Many wealthy people will put some or a large chunk of their money in these city, county, state, or federal government bond investments because they aren’t looking to make a killing in the stock market. They just want to try and preserve what they have. They lend money to the municipal, state and federal governments so the government can build, fix things (such as schools, water systems, roads, etc) and or the funds provide services for the community where the funds are invested.

The government in turn creates an incentive to invest in their projects by making the interest earned, tax free. So when you hear about Buffett, Romney, or other super wealthy who actually built business and earned their money, investing in tax free municipal and or treasury bonds, and who pay a lower capital gains rate on their other investments, now we have an idea why this is the case.

Just keep in mind that in terms of tax dollars, they pay a lot more than most of us.

[13] Who can Invest in These “Tax Free” Government Bonds?

ANYONE can invest in municipal or other government bonds and often times the minimum investment is just $1,000. There are inherit risks, and rates are very low right now, so if considering this, please see a qualified investment professional and tax advisor before investing. Some municipal bonds may be subject to the Alternative Minimum Tax (AMT). Make sure if buying muni-bonds that you won’t be subject to AMT!

[14] The U.S.A. Has a Progressive Tax System

What people need to keep in mind is that the so called “rich” don’t have a special lower tax bracket and everyone else is subject to a higher bracket. Anyone who thinks this is true is living a complete fantasy. The United States has a progressive tax system, which means the more you make the more you pay.

[15] Exception: Estate “Death” Taxes

Inherited money may be subjected to its own set of estate taxes. These taxes are not considered “earned income,” or “capital gains,” so the government has a special set of taxes to capture money that someone else already earned and paid taxes on, only to tax them again when they die.

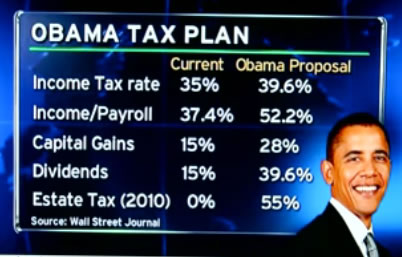

[16] Taxes Going Up?

In January 2010, the Staff of the Joint Committee on Taxation published a report (PDF) which outlines federal tax provisions that are set to expire through 2020. If the so called “Bush Tax Cuts” expire at the end of 2012, there will be some $1 Trillion of new taxes that will hit especially on job creators such as small businesses in January 2013. Despite popular belief, the Bush Tax Cuts shifted the tax burden toward the wealthy, and reduced taxes for the less wealthy by up to 33% (Report: What Tax Cut).

[17] Stealth Tax Hikes for the Middle Class

Next, the Alternative Income Tax (AMT) is expected to increase its impact by 626% from 2011 to 2012. Whereas in 2011 there were 4.3 million Americans impacted by AMT. Unless Congress changes the law this year, as many as 31.2 million people will be affected by AMT (Source: Tax Policy Center, Urban Institute and Brookings Institution).

The AMT is moving to impact the middle-class worker. For 2011, those with joint incomes of just $74,450 or single incomes of $48,450 may find themselves subject to AMT unless Congress takes action to change this. If no action is taken, each year AMT will begin to affect more and more people with lower incomes (Source: Tax Policy Center, Urban Institute and Brookings Institution).

The federal government knew that the AMT tax would be a problem for the middle-class back in 2001.

“In 1990, the AMT financially affected only about 132,000 taxpayers. In 2000, it affected an estimated 1.3 million taxpayers, and in 2010, it is projected to affect 17 million taxpayers.”

— Source: Joint Economic Committee, United States Congress, May 2001 (PDF 19pps) (share link)

The above 2010 estimate was higher than the actual estimate mostly because Congress changed the law temporarily to exempt more middle-class people from AMT. That law expires in 2012 (Source: Journal of Accountancy). (List of Expiring Tax Provisions 2010-2020, 39pps PDF.)

[18] How Everyone’s Taxes Can Go up Automatically in the Future

Beginning in 2009, the Democratic controlled 111th Congress widened the tax brackets to adjust for inflation. What this means is that everyone’s taxes will be going up…everyone. The reason why we have not seen huge increases now is because government math for inflation has been kept artificially low. However, if you buy gas, use heat, or eat food you probably have seen that you are paying more and getting less. This is inflation in food and energy prices; data the government is ignoring because they can’t control it.

“The BLS publishes thousands of CPI indexes each month, including the headline All Items CPI for All Urban Consumers (CPI-U) and the CPI-U for All Items Less Food and Energy.”

[NOTE: Semantics: “Less” in the above paragraph means EXCEPT, NOT included.] Continuing…

“The latter series, widely referred to as the “core” CPI, is closely watched by many economic analysts and policymakers under the belief that food and energy prices are volatile and are subject to price shocks that cannot be damped through monetary policy. However, all consumer goods and services, including food and energy, are represented in the headline CPI.”

[NOTE: Semantics: “cannot be damped through monetary policy” in the above paragraph means, “cannot be controlled.”

In other words, the government can’t control food and energy prices, so they just prefer to exclude that number and make a separation inflation calculation without it.

So, next time you buy groceries or gas, just tell your spouse that you also plan to go shopping for some expensive items, because the price of food and energy is irrelevant when it comes to living expenses, right?]

— Source: Bold type in quotes from: U.S. Bureau of Labor Statistics (BLS.gov) 1 page, PDF – highlighted to point out area of conversation. [“NOTES” in square brackets just above, translated from “government speak” into simple language for improved clarity and understanding by NetAdvisor™].

We discussed how inflation has already arrived in our 2010 article posted here.

Now as for the stealth tax increases we talked about, here is what the IRS has posted:

“For 2009, personal exemptions and standard deductions will rise and tax brackets will widen because of inflation adjustments announced today by the Internal Revenue Service. By law, the dollar amounts for a variety of tax provisions must be revised each year to keep pace with inflation.”

If one is wondering where this sneaky tax hike came from, look no further than Nancy Pelosi’s (D-CA) / Obama’s Health-Care Bill.

“Buried in Nancy Pelosi’s health-care bill is a provision that will partially repeal tax indexing for inflation, meaning that as their earnings rise over a lifetime these youngsters can look forward to paying higher rates even if their income gains aren’t real…”

“…This is a sneaky way for politicians to pry more money out of workers every year without having to legislate tax increases.”

— Source: Wall Street Journal (PDF), 11-6-2009

So when you hear political pundits acting to get the rich to pay their “fair share,” even though they pay most of the income taxes the government receives; or that the biggest part of the U.S. deficit is being caused by the Bush tax cuts (also false), remember to ask them about why low and middle income people are being affected by both AMT and the inflation tax buried in ObamaCare?

Additional Resources:

Taxpayer Guide to Identity Theft (Source: IRS.gov) Local PDF

Tips for Choosing a Tax Return Preparer (Source: IRS.gov) Local PDF

Images/ graphics may be copyright by their respective owners where known or credited.

original article content, Copyright © 2012-2013 NetAdvisor.org™ All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.